Medicare: What You Need to Know

Medicare is a health insurance program for:

- people age 65 or older,

- people under age 65 with certain disabilities, and

- people of all ages with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant).

-

Part A Hospital Insurance

Most people don't pay a premium for Part A because they or a spouse already paid for it through their payroll taxes while working. Medicare Part A (Hospital Insurance) helps cover inpatient care in hospitals, including critical access hospitals, and skilled nursing facilities (not custodial or long-term care). It also helps cover hospice care and some home health care. Beneficiaries must meet certain conditions to get these benefits.

-

Part B Medical Insurance

Most people pay a monthly premium for Part B. Medicare Part B (Medical Insurance) helps cover doctors' services and outpatient care. It also covers some other medical services that Part A doesn't cover, such as some of the services of physical and occupational therapists, and some home health care. Part B helps pay for these covered services and supplies when they are medically necessary.

-

Prescription Drug Coverage

Most people will pay a monthly premium for this coverage. In January 1, 2006, Medicare prescription drug coverage became available to everyone with Medicare. This coverage is to help you lower prescription drug costs and help protect against higher costs in the future. Medicare Prescription Drug Coverage is insurance. Private companies provide the coverage. Beneficiaries choose the drug plan and pay a monthly premium. Like other insurance, if a beneficiary decides not to enroll in a drug plan when they are first eligible, they may pay a penalty if they choose to join later.

-

What is Medicare Supplement (Medigap) Insurance?

A Medicare Supplement (Medigap) insurance, sold by private companies, can help pay some of the health care costs that Original Medicare doesn't cover, like co-payments, coinsurance, and deductibles.

If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Your Medigap policy pays its share.

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

What you need to know about Medicare Supplement policies

- You must have Medicare Part A and Part B.

- If you have a Medicare Advantage Plan, you can switch to a Medicare Supplement insurance policy, but make sure you can leave the Medicare Advantage Plan before your Medicare Supplement insurance policy begins.

- You pay the private insurance company a monthly premium for your Medicare Supplement insurance policy in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

- You can buy a Medicare Supplement insurance policy from any insurance company that's licensed in your state to sell one.

- Any standardized Medicare Supplement insurance policy is guaranteed renewable even if you have health problems. This means the insurance company can't cancel your Medicare Supplement insurance policy as long as you pay the premium.

- Medicare Supplement insurance policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).

- It's illegal for anyone to sell you a Medigap policy if you have a Medicare Medical Savings Account (MSA) Plan.

Information obtained from www.medicare.gov

-

Compare Medicare Supplement Plans Side-by-Side

Compare Medicare Supplement Plans Side-by-Side

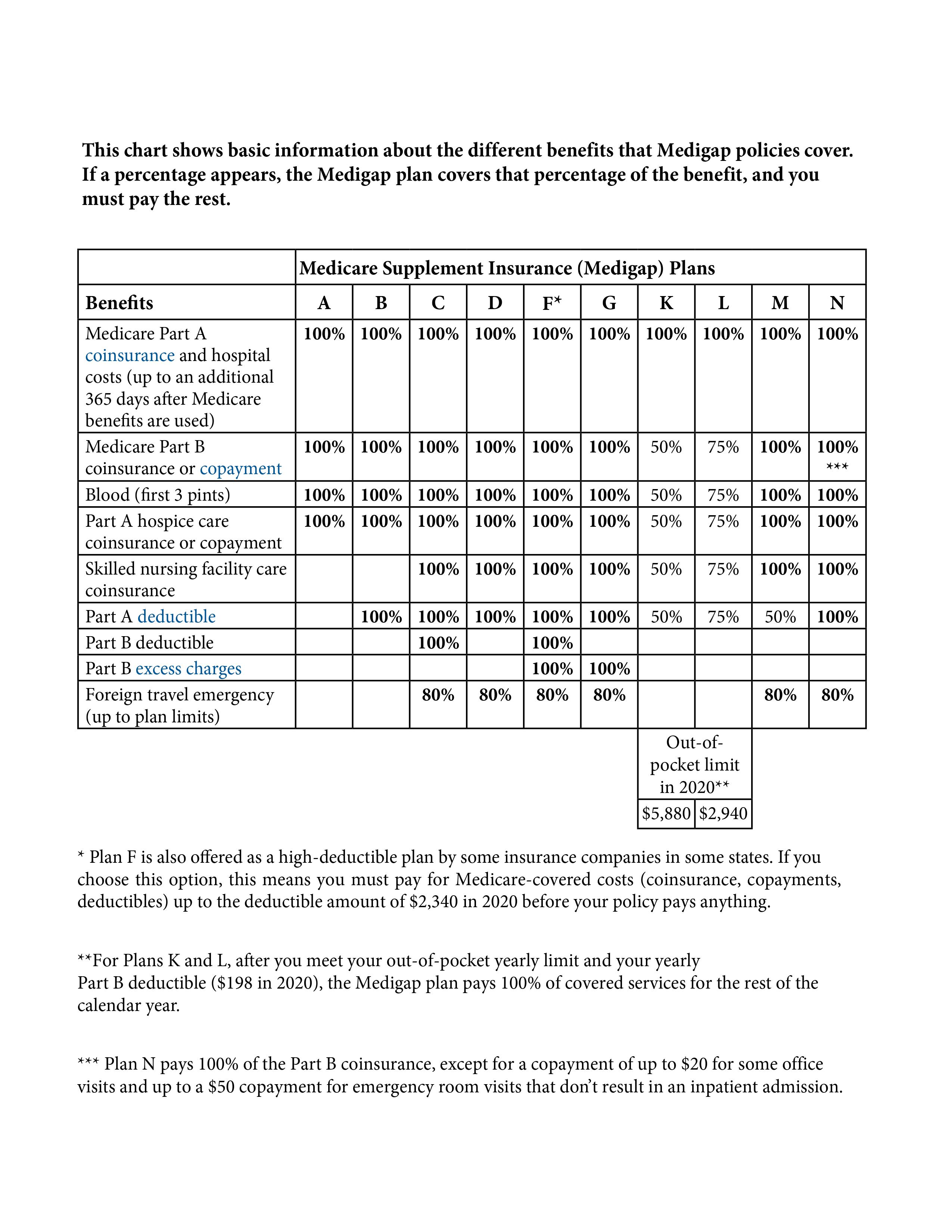

Compare Medicare Supplement Plans Side-by-SideMedicare Supplement policies (also known as Medigap policies) are standardized and must follow federal and state laws designed to protect you. Insurance companies can only sell you a "standardized" policy identified in most states by letters (see the chart below).

All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs. As you can see in the comparison chart there are many options from which to choose. As licensed insurance agents we can help you understand the differences between the plans so that you can decide on the right plan for you.

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Did you know that each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don't have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

Keep in mind that the Medicare Supplement policy covers co-insurance after you've paid the deductible (unless the Medigap policy also pays the deductible).

Compare Medicare Supplement Plans Side-By-Side

The chart below shows basic information about the different benefits Medigap policies cover.- Yes = the plan covers 100% of this benefit

- No = the policy doesn't cover that benefit

- % = the plan covers that percentage of this benefit

- N/A = not applicable

*Plan F also offers a high-deductible plan. If you choose this option, this means you must pay for Medicare-covered costs up to the deductible amount of $2,240 in 2019 before your Medigap plan pays anything.

**After you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

***Plan N pays 100% of the Part B coinsurance, except for a co-payment of up to $20 for some office visits and up to a $50 co-payment for emergency room visits that don't result in inpatient admission.

-

Different Types of Medicare Advantage Plans

Medicare Advantage is a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits.

Medicare Advantage Plans Include The Following:

Health Maintenance Organization (HMO) Plan

In most HMO Plans, you can only go to doctors, other health care providers, or hospitals on the plan's list except in an emergency. You may also need to get a referral from your primary care doctor to see other doctors or specialists. Find and compare HMO Plans in your area.Preferred Provider Organization (PPO) Plans

A Medicare PPO Plan is a type of Medicare Advantage Plan (Part C) offered by a private insurance company. In a PPO Plan, you pay less if you use doctors, hospitals, and other health care providers that belong to the plan's network. You pay more if you use doctors, hospitals, and providers outside of the network.Private Fee-for-Service (PFFS) Plans

A Medicare PFFS Plan is a type of Medicare Advantage Plan (Part C) offered by a private insurance company. PFFS plans aren’t the same as Original Medicare or Medigap. The plan determines how much it will pay doctors, other health care providers, and hospitals, and how much you must pay when you get care.Medicare Special Needs (SNP) Plans

Medicare SNPs are a type of Medicare Advantage Plan (like an HMO or PPO). Medicare SNPs limit membership to people with specific diseases or characteristics, and tailor their benefits, provider choices, and drug formularies to best meet the specific needs of the groups they serve. Find out who can join a Medicare SNP.These definitions are directly from www.medicare.gov

-

Part D Prescription Drug Plans

You can sign up for Part D Prescription Drug Plans, which helps cover prescription drug costs, along with other components of Medicare starting three months before your 65th birthday.

It's important to do this on time because there's a permanent premium surcharge for enrolling more than three months after your 65th birthday if you don't have equivalent drug coverage from another source, such as a retiree plan.

Let us help you with your enrollment

If you are already enrolled in a Part D "standalone" plan or a Medicare Advantage plan that incorporates drug coverage, you can switch plans during the open-enrollment period, which runs from Oct. 15 to Dec. 7 every year.

Choosing a plan

It pays to review your Part D coverage every year, especially if you have started taking new drugs.

- Start at Medicare.gov. You can find the basics about the benefit and Part D plans at Medicare's website. There's a link to the Medicare Part D Plan Finder, which allows you to compare offerings and coverage options in your area and includes a helpful formulary finder that allows you to compare plans based on their coverage of your personalized list of drugs. It will even show you your monthly out-of-pocket drug cost for the year.

- Learn more. We recommend consulting the website of the nonprofit Medicare Rights Center. There you can find in-depth information on Medicare Part D.

Getting financial help

Individuals with annual incomes of less than $17,820 and financial resources of less than $13,640, or married couples with incomes of less than $27,250, might qualify for Extra Help from Medicare to pay their Part D premiums and out-of-pocket drug costs.

Download Medicare's instructions on applying for the Extra Help program.

Additionally, read about the six ways to lower your drug costs on Medicare.gov.

This information was obtained from www.medicare.gov